As global markets navigate inflation, geopolitical risk, and the clean-energy transition, Africa’s mineral sector is once again the focus of capital allocation decisions. Two commodities dominate investor conversations: gold, the traditional safe-haven asset, and lithium, the strategic metal powering electric vehicles (EVs) and energy storage.

Both minerals are abundant on the continent. But they attract different types of investments — and reveal where investor confidence is strongest in 2026.

Read more on Africa’s Mining Investment Outlook 2026: What Global Capital Is Watching

Gold: Safe-Haven Demand in Turbulent Times

Despite economic volatility, gold continues to attract steady investment in Africa.

Why Gold Still Matters

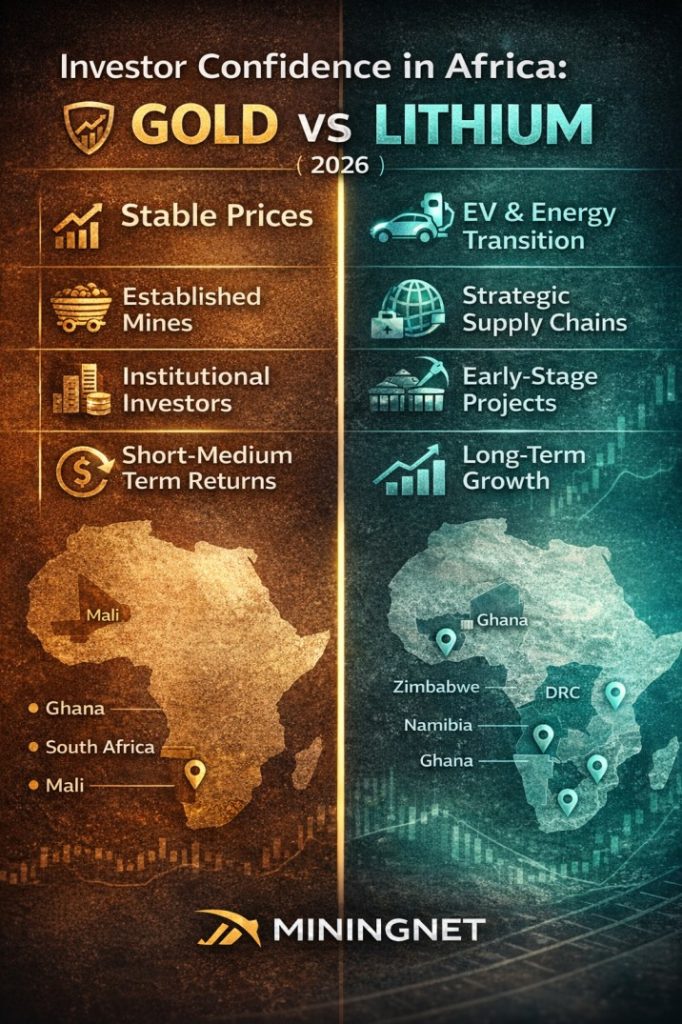

Investors see gold as a hedge against uncertainty especially when inflation and currency risks remain elevated. African nations such as Ghana, South Africa, Tanzania, and Mali have well-established gold mining industries that provide consistent production and stable cash flows.

In recent market activity, Uganda’s gold exports surged by 76% in 2025, highlighting persistent demand for bullion even in challenging markets. This dynamic underscores gold’s role as a safe-haven asset in investor portfolios.

For many institutional investors and pension funds, gold isn’t necessarily a growth story. it’s capital preservation with reliable returns.

Lithium: Africa’s Entry Into the Energy Transition

Unlike gold, lithium’s rise is tied directly to the global energy transition and electrification of transportation. As EV adoption accelerates worldwide, lithium essential for battery manufacturing has captured strategic interest.

The African Lithium Narrative

Africa’s lithium profile has expanded rapidly. Zimbabwe, Namibia, Ghana, and the Democratic Republic of Congo are now among the continent’s most active lithium jurisdictions, with Zimbabwe already leading production.

Investors in the lithium space are often long-term, growth-oriented, and willing to engage earlier in a project’s life cycle. But these opportunities carry risks: supply-chain squeeze points, price volatility, and permitting challenges especially as African countries refine their fiscal and mineral codes.

In Ghana, for example, Atlantic Lithium has been navigating regulatory negotiations with the government as both sides weigh local value addition and investor confidence.

Comparing Investor Confidence: Gold vs Lithium

| Investor Factor | Gold | Lithium |

|---|---|---|

| Risk Profile | Lower | Higher |

| Price Stability | More Stable | Volatile |

| Investor Type | Institutional & Defensive | Strategic & Growth |

| Project Maturity | Established Assets | Early- to Mid-Stage |

| Infrastructure | Strong | Developing |

Where Capital Is Going

- Gold continues to attract steady institutional investment, buoyed by predictable returns and strong cash flow.

- Lithium is attracting strategic capital, especially from battery manufacturers and sovereign investors seeking EV supply security.

Capital directed toward gold remains larger in absolute terms, but the pace of deals in lithium exploration and development suggests rising confidence in its long-term demand.

Policy, ESG, and Local Content: Confidence Drivers

Investor confidence isn’t just about geology — it’s about jurisdictional clarity.

- Gold jurisdictions benefit from decades of established mining governance but face increasing environmental and social governance (ESG) expectations.

- Lithium jurisdictions are crafting new regulatory frameworks that aim to attract investment while maximizing local industrial benefits, a key confidence metric for global capital.

Countries that can combine clear fiscal policy, transparent permitting, and supportive infrastructure are succeeding in drawing investment across mineral types.

Conclusion: Dual Confidence, Different Paths

There isn’t a single “winner.” Instead:

- Gold continues to win investor confidence as a defensive asset with dependable returns.

- Lithium is winning confidence among capital seeking exposure to Africa’s role in the energy transition.

For investors and mining stakeholders in Africa, the most strategic approach may be diversification balancing the reliable foundation of gold with the high-growth promise of lithium.